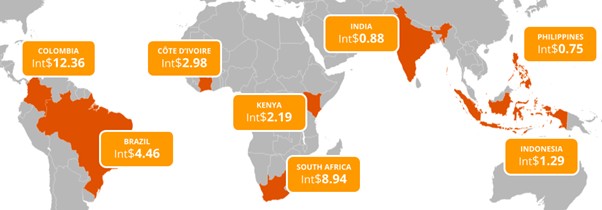

Global Digital Inclusion Partnership collected prepaid tariff data from the major mobile network operators across eight global majority countries to understand pricing trends and strategies. Here’s what we found out:

- Not all prepaid data packets are the same

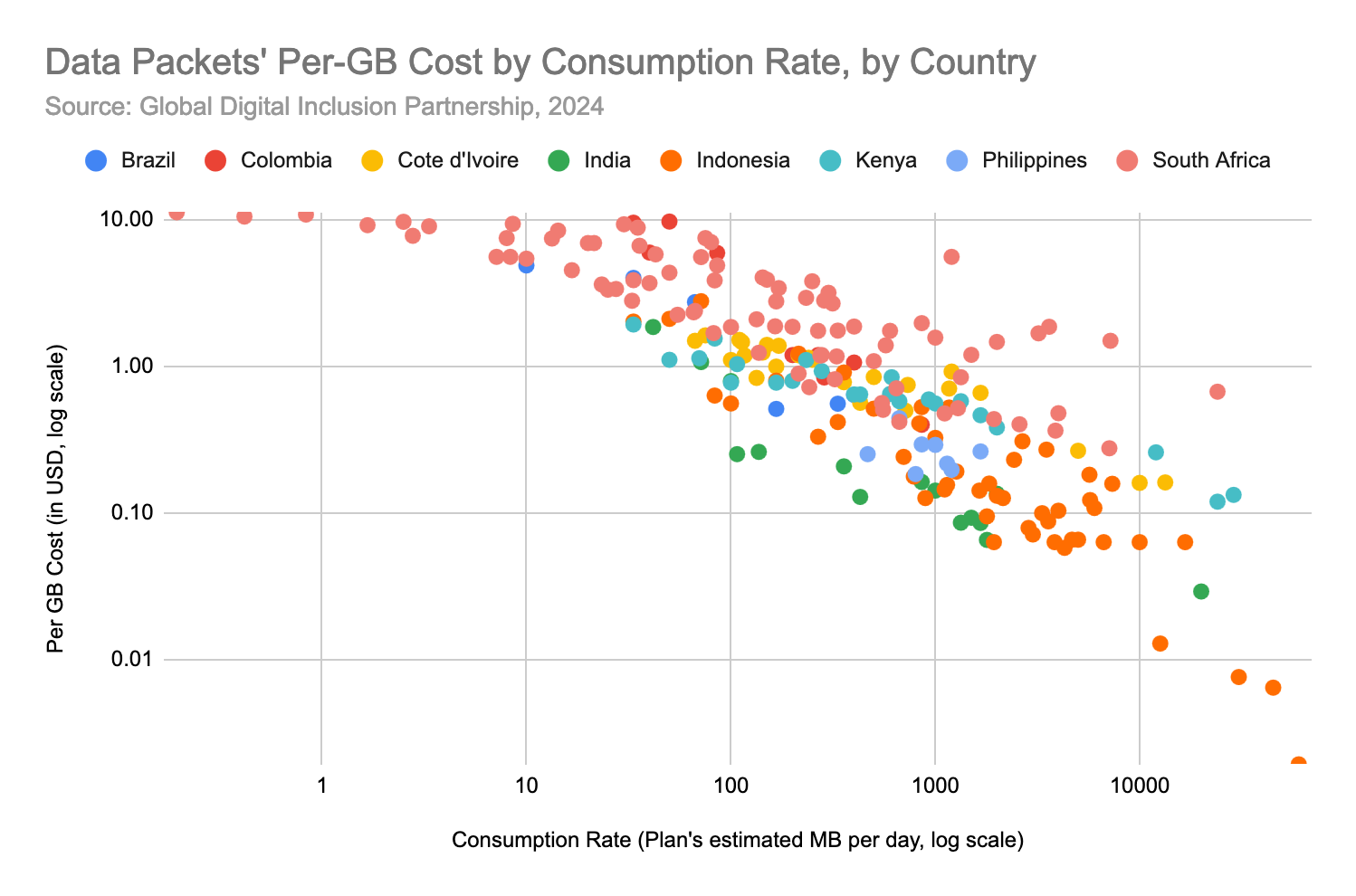

- Consumers pay more for smaller packets and slower data consumption over time

- The spread of prepaid offers demonstrates a cost barrier set against low-income users

Consumers pay more for using their data over time at a slower pace. When we analyze packets by their assumed rate of consumption, data packets with the lowest rates of consumption (longer validities and smaller data volumes) have some of the highest per-gigabyte costs — sometimes paying more than twice per gigabyte than the average tariff.

For example, a Vodacom customer in South Africa could pay 73 rand for 1.2 GB, which is valid for one week, or they could pay 89 rand for the same tariff for over a month. It has the same volume of data, but the customer has to effectively pay for the privilege of rationing their data over four weeks if they’re not a high-consumption user. Just as lower-income people are using mobile broadband for the first time, the initial taste of connectivity is simply too expensive.

Advocacy experience: GDIP campaigning on #DataIsNotMilk

In South Africa, GDIP Executive Director Onica N. Makwakwa has led efforts to raise awareness on the harm caused by fast-expiring data plans. Without sufficient consumer protections in the mobile market, expired data plans leave consumers without the option to roll over to a new plan or use the data they’ve paid for.

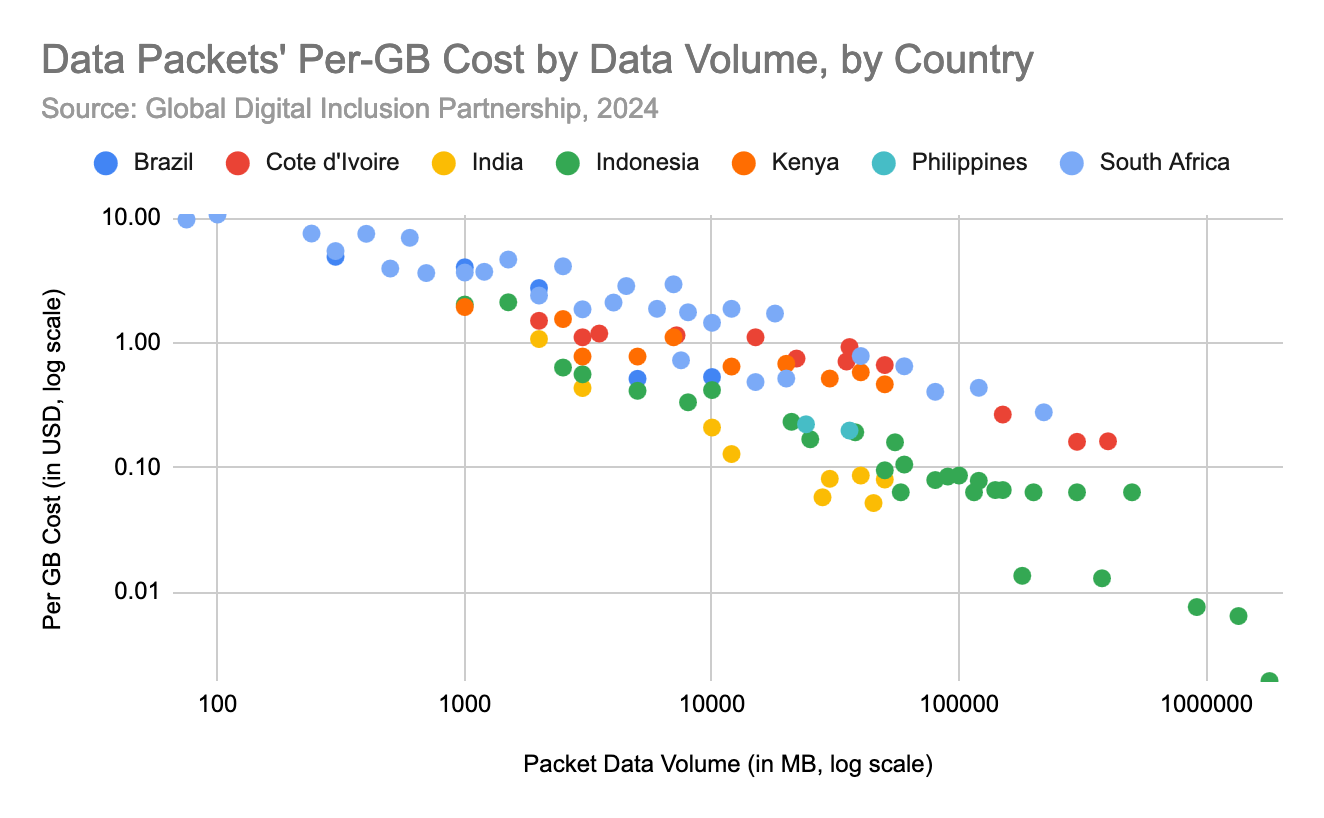

Consumers pay more for buying in smaller volumes. Across all markets, ‘bulk buying’ means higher-consumption users see cost savings at a per-gigabyte level. Inversely, this means that lower-income users buying smaller volumes that they can afford are paying more for mobile data services. This occurs even when controlling for packet validity periods (comparing daily plans to other daily plans, weekly to other weekly plans, etc.).

For example, this happened to Claro customers in Brazil: buying a data plan for one month, they could spend 7.99 reais for 300 MB (effective cost of USD 4.90 per GB) or 29.99 reais for 2 GB (effective cost of USD 2.80), meaning consumers buying the 300 MB plan were paying more for each message, video, or website they load compared to their peers on the 2 GB plan. This is how this pricing trend can pose a challenge for lower-income or marginal users who only pay for data in smaller packets.

As a consequence of these market forces, lower-income users are paying more per gigabyte than more affluent users who can afford to ‘bulk buy’ or purchase in larger volumes. This creates a double-edged barrier for affordable pricing: whether planning over longer terms and rationing their data or buying small packets with shorter durations, users who seek lower price tags are paying more per gigabyte for the services on the same networks.

Packet-level pricing data like this enables a richer picture of the way that mobile broadband prices relate to digital inclusion. This approach complements other data collection efforts like those of the International Telecommunication Union and of Cable.co.uk, which provide national-level benchmarked and averaged data prices each. Through this data, it exposes the variance that consumers face within a market and among different offers.

Inclusive data pricing must recognise this barrier and what it means for digital inclusion. This is an ongoing conversation for all stakeholders within the ICT sector on how to make meaningful connectivity affordable and accessible for everyone — including where mobile broadband can contribute to that vision. Strategies such as our Policy and Regulatory Good Practices illustrate various ways that can help reduce the cost of mobile broadband across the board — within that includes an ambition to reduce barriers that unequally disadvantage vulnerable groups or further marginalize underserved communities.

If we fail to close pricing gaps that disadvantage lower-income users who spend less on broadband than higher-income neighbours, we will never achieve universal affordability. More research is needed to distinguish between how much of this gap reflects cost-based pricing versus how much is predatory marketing to upsell users into higher volumes and more frequent purchases. Current prices do the greatest harm to those at the greatest risk of being left behind.

Links to the GDIP dataset that informs this briefing:

For more information, please contact:

press@globaldigitalinclusion.org or visit Media Contacts page.

About GDIP

The Global Digital Inclusion Partnership is a coalition of public, private, and civil society organizations working to bring internet connectivity to the global majority and ensure everyone is meaningfully connected by 2030. GDIP advances digital opportunities to empower and support people’s lives and agency, leading to inclusive digital societies.